All Categories

Featured

Table of Contents

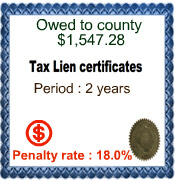

For instance, if the home owner pays the rate of interest and penalties early, this will certainly minimize your return on the financial investment. And if the property owner states insolvency, the tax lien certification will certainly be subservient to the home loan and federal back taxes that schedule, if any kind of. Another threat is that the worth of the property could be less than the quantity of back tax obligations owed, in which situation the home owner will certainly have little reward to pay them.

Tax lien certificates are normally offered via public auctions (either online or personally) conducted every year by county or metropolitan straining authorities. Available tax obligation liens are typically released several weeks prior to the auction, together with minimal quote quantities. Examine the web sites of regions where you want purchasing tax obligation liens or call the region recorder's workplace for a listing of tax obligation lien certificates to be auctioned.

Tax Lien Certificate Investing

A lot of tax obligation liens have an expiry day after which time your lienholder civil liberties run out, so you'll need to relocate swiftly to increase your possibilities of maximizing your investment return. Tax obligation lien investing can be a lucrative way to buy actual estate, however success requires extensive research and due persistance

Firstrust has even more than a years of experience in providing funding for tax obligation lien investing, along with a committed group of licensed tax obligation lien professionals who can aid you utilize potential tax obligation lien investing opportunities. Please call us to find out more regarding tax obligation lien investing. FT - 643 - 20230118.

The tax obligation lien sale is the final action in the treasurer's efforts to collect taxes on real estate. A tax lien is put on every region residential or commercial property owing tax obligations on January 1 yearly and continues to be up until the residential or commercial property taxes are paid. If the home proprietor does not pay the residential property taxes by late October, the area sells the tax lien at the annual tax obligation lien sale.

The financier that holds the lien will be notified every August of any kind of unsettled tax obligations and can endorse those tax obligations to their existing lien. The tax lien sale allows exhausting authorities to receive their allocated income without needing to wait for overdue taxes to be gathered. It also offers a financial investment possibility for the basic public, members of which can purchase tax obligation lien certifications that can potentially gain an attractive rates of interest.

When redeeming a tax lien, the homeowner pays the the overdue tax obligations as well as the delinquent passion that has actually accumulated against the lien considering that it was cost tax sale, this is credited to the tax lien owner. Please contact the Jefferson County Treasurer 303-271-8330 to obtain payback details.

Are Tax Liens A Good Investment

Home becomes tax-defaulted land if the real estate tax continue to be overdue at 12:01 a.m. on July 1st. Building that has ended up being tax-defaulted after 5 years (or three years in the case of property that is also based on a problem abatement lien) becomes based on the area tax collection agency's power to sell in order to satisfy the defaulted residential or commercial property tax obligations.

The region tax obligation collector may supply the residential property up for sale at public auction, a sealed proposal sale, or a worked out sale to a public firm or certified not-for-profit organization. Public public auctions are the most common method of offering tax-defaulted residential or commercial property. The public auction is conducted by the area tax collection agency, and the home is marketed to the greatest prospective buyer.

Secret Takeaways Navigating the globe of real estate financial investment can be complex, but understanding various financial investment opportunities, like, is well worth the work. If you're wanting to expand your portfolio, purchasing tax obligation liens may be a choice worth exploring. This guide is created to assist you recognize the essentials of the tax lien financial investment method, directing you through its process and assisting you make notified decisions.

A tax obligation lien is a legal case imposed by a federal government entity on a building when the owner falls short to pay home tax obligations. It's a means for the federal government to ensure that it gathers the needed tax obligation earnings. Tax obligation liens are connected to the residential property, not the individual, implying the lien stays with the home no matter ownership adjustments till the financial debt is cleared.

Tax Lien Investing Strategies

Tax lien investing is a type of real estate investment that entails acquiring these liens from the federal government. When you spend in a tax obligation lien, you're basically paying somebody else's tax obligation financial debt.

As a capitalist, you can acquire these liens, paying the owed taxes. In return, you obtain the right to collect the tax financial debt plus passion from the property owner.

It's vital to thoroughly weigh these prior to diving in. Tax obligation lien certification spending offers a much reduced resources demand when compared to various other forms of investingit's possible to delve into this asset course for just a couple hundred bucks. One of the most significant draws of tax lien investing is the possibility for high returns.

Sometimes, if the homeowner fails to pay the tax obligation debt, the investor may have the chance to foreclose on the residential property. This can possibly cause obtaining a home at a portion of its market price. A tax obligation lien commonly takes top priority over other liens or mortgages.

Tax obligation lien spending involves navigating legal procedures, especially if foreclosure comes to be necessary. Redemption Periods: Property owners typically have a redemption period during which they can pay off the tax obligation financial obligation and rate of interest.

Competitive Public auctions: Tax obligation lien public auctions can be extremely affordable, particularly for homes in preferable locations. This competition can increase prices and potentially reduce general returns. [Knowing exactly how to purchase realty does not need to be tough! Our online property spending course has every little thing you require to shorten the understanding contour and start spending in property in your location.

Tax Lien And Tax Deed Investing

:max_bytes(150000):strip_icc()/taxliencertificate.asp-final-b2b6b823202f45b9ab56efc51304ed44.png)

While these procedures are not complicated, they can be shocking to brand-new capitalists. If you are interested in starting, review the following steps to purchasing tax obligation liens: Start by informing yourself concerning tax liens and how real estate auctions work. Recognizing the lawful and monetary complexities of tax lien investing is necessary for success.

Latest Posts

Foreclosure Overages Business

How Does Investing In Tax Liens Work

Investing In Tax Lien Certificates