All Categories

Featured

Table of Contents

The SEC controls the regulations for buying and marketing safety and securities consisting of when and how safety and securities or offerings have to be signed up with the SEC and what sorts of financiers can take part in a specific offering - returns for accredited investors. As an online commercial property spending market, every one of our financial investment chances are offered only to certified investors

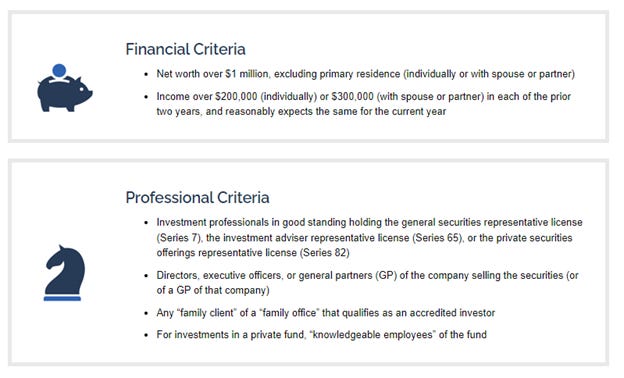

Put merely, you're an accredited financier if: OR ORYou are a holder in excellent standing of the Collection 7, Series 65, or Collection 82 licenses An accredited financier doesn't have to be a private person; trust funds, particular pension, and LLCs may also get approved for recognized financier status. Each investing capacity might have a little various criteria to be taken into consideration certified, and this flowchart describes the accreditation requirements for all entity kinds.

Within the 'accreditation confirmation' tab of your, you will be given the complying with choices. Upload financials and paperwork to reveal evidence of your accredited standing based on the demands summed up above., permit #"); AND clearly state that the investor/entity is a recognized investor (as specified by Rule 501a).

Profitable Accredited Property Investment Near Me

Please note that third-party letters are only legitimate for 90 days from day of issuance. Per SEC Guideline 230.506(c)( 2 )(C), before accepting a financier right into an offering, sponsors have to obtain written proof of a financier's accreditation condition from a qualified third-party. If a third-party letter is given, this will be passed to the sponsor directly and should be dated within the previous 90 days.

After a year, we will certainly require updated monetary documents for review. To learn more on approved investing, visit our Accreditation Overview posts in our Help Facility.

The test is anticipated to be readily available sometime in mid to late 2024. The Equal Possibility for All Investors Act has actually already taken a substantial step by passing the House of Reps with a frustrating ballot of support (383-18). accredited investor alternative assets. The next stage in the legal procedure includes the Act being reviewed and voted upon in the Us senate

Innovative Commercial Real Estate For Accredited Investors Near Me

Provided the rate that it is moving currently, this can be in the coming months. While exact timelines are unsure, given the substantial bipartisan support behind this Act, it is anticipated to progress with the legal process with family member rate. Presuming the 1 year home window is offered and achieved, indicates the text would certainly be readily available sometime in mid to late 2024.

For the average investor, the monetary landscape can occasionally feel like a complicated maze with minimal access to particular financial investment possibilities. Within this realm exists an unique category known as certified capitalists. If you've ever wondered what sets recognized investors apart, this write-up gives an overview. A lot of investors do not get accredited investor condition as a result of high earnings level needs.

Leading Real Estate Crowdfunding Accredited Investors Near Me – Honolulu 96801 HI

Join us as we debunk the world of accredited financiers, unraveling the significance, needs, and potential advantages related to this designation. Whether you're new to spending or seeking to broaden your economic perspectives, we'll clarify what it indicates to be an accredited financier. While companies and financial institutions can receive certified financial investments, for the purposes of this article, we'll be reviewing what it implies to be an accredited capitalist as an individual.

Private equity is likewise an illiquid property class that looks for long-term admiration away from public markets. 3 Private placements are sales of equity or financial obligation placements to competent investors and institutions. This type of investment typically offers as a choice to other techniques that might be taken to increase resources.

7,8 There are numerous disadvantages when taking into consideration an investment as a certified financier. Start-up companies have high failing rates. While they might show up to offer tremendous possibility, you might not recover your initial financial investment if you take part. 2 The investment automobiles supplied to accredited financiers often have high financial investment demands.

A performance fee is paid based on returns on an investment and can range as high as 15% to 20%. 9 Lots of approved financial investment vehicles aren't quickly made liquid ought to the need develop.

Best Tax-advantaged Investments For Accredited Investors Near Me

Please get in touch with legal or tax professionals for specific information concerning your individual scenario. This material was established and created by FMG Collection to offer details on a subject that may be of rate of interest.

The opinions expressed and worldly given are for basic information, and ought to not be taken into consideration a solicitation for the acquisition or sale of any kind of security. Copyright FMG Suite.

Approved financiers consist of high-net-worth individuals, financial institutions, insurer, brokers, and counts on. Accredited investors are defined by the SEC as qualified to spend in complicated or sophisticated kinds of safety and securities that are not carefully regulated. Particular criteria have to be fulfilled, such as having a typical annual income over $200,000 ($300,000 with a partner or residential partner) or working in the monetary sector.

Unregistered safeties are inherently riskier because they lack the typical disclosure demands that come with SEC enrollment., and numerous bargains entailing complicated and higher-risk investments and tools. A business that is seeking to increase a round of financing might decide to straight come close to recognized investors.

Quality Passive Income For Accredited Investors – Honolulu 96801 HI

It is not a public company yet intends to launch a going public (IPO) in the close to future. Such a company could make a decision to supply protections to certified financiers directly. This type of share offering is referred to as a personal placement. For recognized capitalists, there is a high capacity for risk or incentive.

The policies for certified financiers differ amongst jurisdictions. In the U.S, the meaning of an accredited capitalist is presented by the SEC in Policy 501 of Regulation D. To be an accredited capitalist, a person must have an annual revenue surpassing $200,000 ($300,000 for joint earnings) for the last two years with the expectation of gaining the very same or a higher earnings in the present year.

This amount can not consist of a main residence., executive policemans, or supervisors of a company that is providing unregistered safeties.

Also, if an entity consists of equity proprietors that are recognized investors, the entity itself is a certified investor. A company can not be created with the single purpose of buying details safety and securities. A person can qualify as an approved financier by demonstrating adequate education and learning or job experience in the economic sector.

Latest Posts

Foreclosure Overages Business

How Does Investing In Tax Liens Work

Investing In Tax Lien Certificates